- Red Search

- Resources

- Mobile Operating System Statistics Australia

iOS & Android: Mobile Operating System Statistics Australia (2025)

-

Daniel Law

Daniel Law

Are you team Apple or Android? The battle for smartphone supremacy in Australia is as fierce as the sun at midday! In this article, let us explore the latest stats and settle the score.

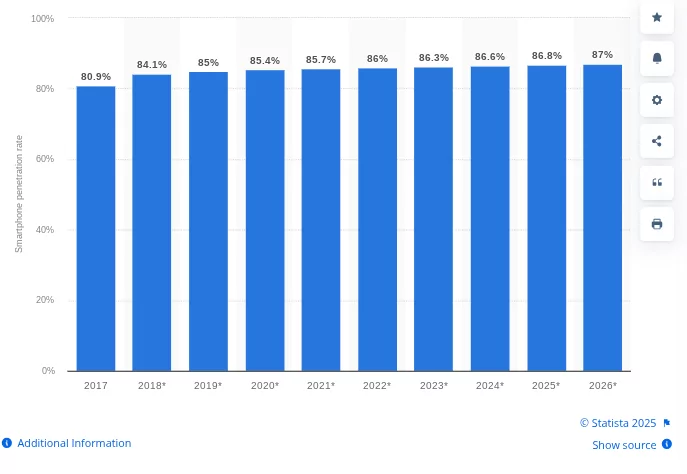

Australia has a high smartphone usage rate, with early estimates in 2017 predicting that it could reach up to 87% by 2026. This is about 23.6 million smartphone users across the country!

Current Mobile OS Market Share Overview

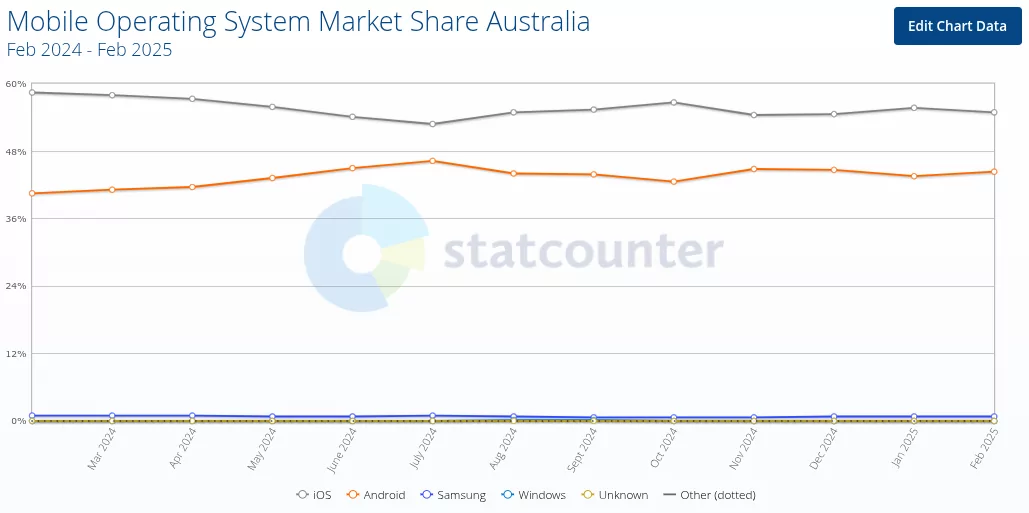

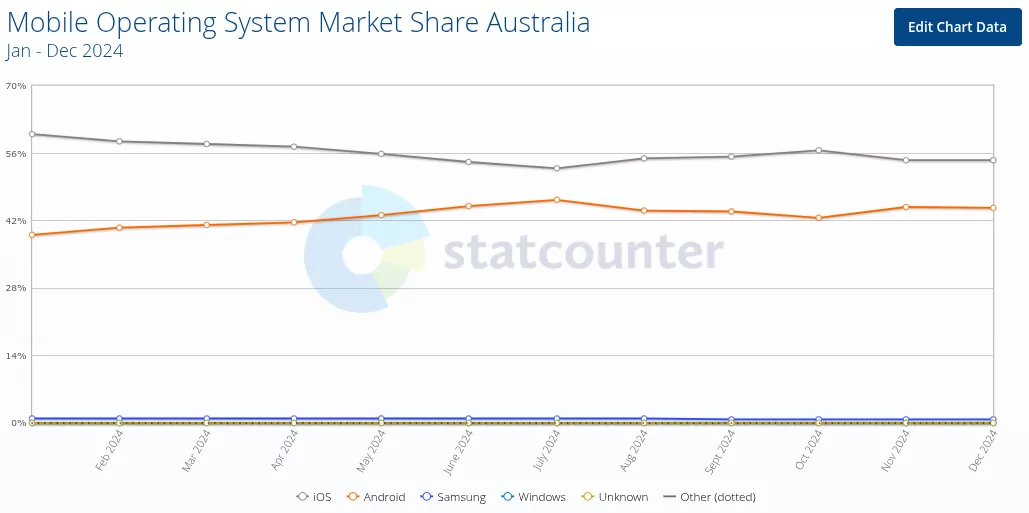

From February 2024 to February 2025, iOS had around 54% share while Android ranked second with 44%. Samsung, Windows, and other OS have barely attracted 2% of mobile users.

From 2020 to 2024, iOS consistently led Australia’s mobile OS market, peaking at 62% in 2023 while Android remained second. Android showed some growth in 2024, briefly reaching 46% in July, but iOS maintained the lead, ending the year at 54% versus Android’s 44%.

Other mobile OS, such as Samsung and Windows, had minimal market presence throughout the period.

Global Mobile OS Market Share Comparison

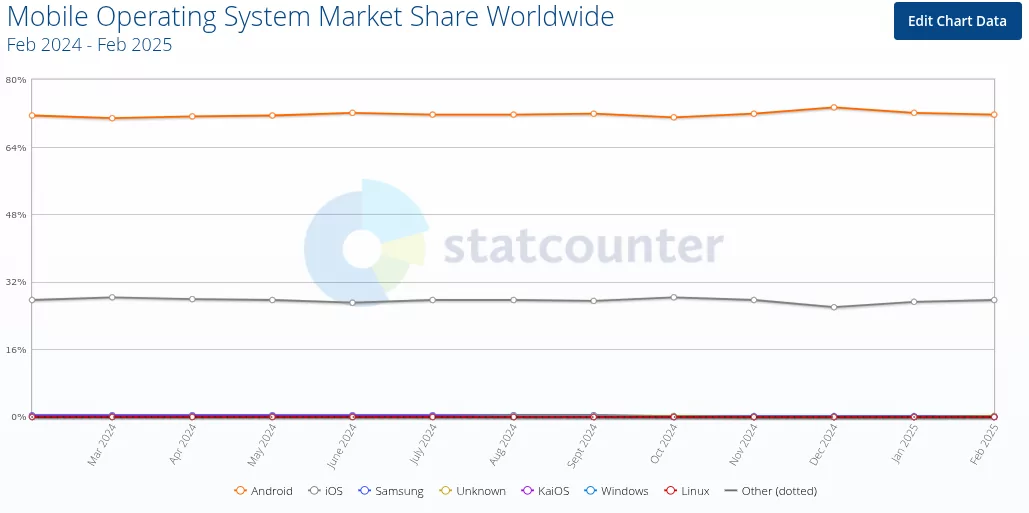

While iOS dominated the Australian mobile OS market, Android is the king of the world.

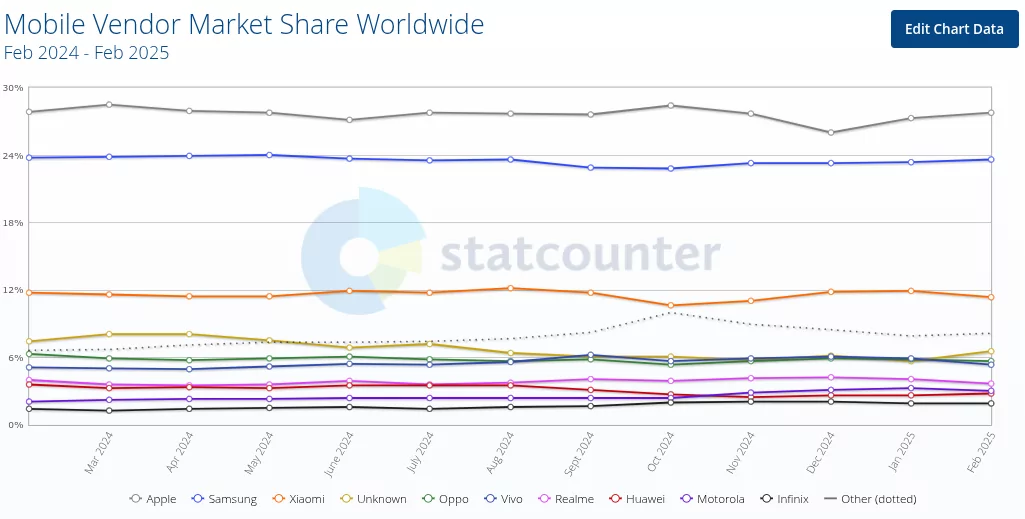

Source: StatCounter

Android OS has a 71% worldwide market share, while iOS has a 27% share.

User Demographics and Usage Patterns

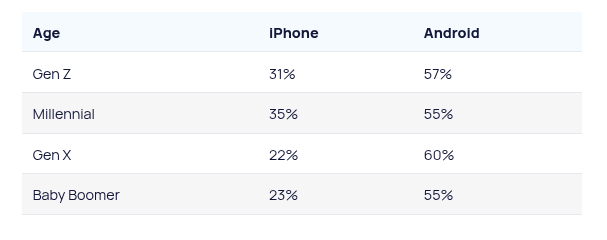

Age Groups Worldwide

Source: Exploding Topics

All age groups prefer Android smartphones to iPhones, which means Android OS is widely used across all generations. The popularity may be attributed to Android phones’ affordability and availability.

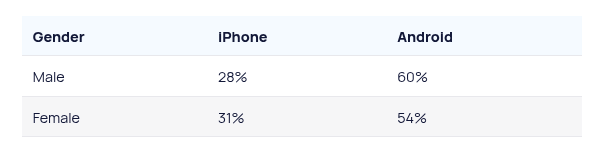

Gender Worldwide

Source: Exploding Topics

The latest survey shows males prefer Android phones (60%) to iPhones (28%). Females prefer Android phones (54%) to iPhones (31%).

Income Segments Worldwide

According to the latest survey, most iPhone users are higher earners, with an average annual salary of $53,251. Meanwhile, Android smartphone users have an average yearly wage of $37,040. It is also worth noting that the latest iPhone model price starts at $799. The average cost of an Android phone is just $286.

Mobile Vendor Market Share Australia

Source: StatCounter

Apple iPhone is currently Australia’s most popular mobile phone brand, with as much as 28.38% market share. Samsung is a strong second at 24% share, while brands like Xiaomi, Oppo, Vivo, and Realme are also making great strides. With the iPhone’s dominance in Australia, it is clear that more mobile phone users prefer iOS to Android OS.

Brand Loyalty Factors

Both iOS and Android users have high retention rates. Android has 89 to 91% retention rates, while iPhone has 85 to 88%. This means people pick the brand they prefer and stick with it long-term.

But there are still people who switched to a different mobile OS. Around 18% of iPhone users were once Android users, stating they switched because of the iPhone’s better user experience. Around 29% of Android users were previously iPhone users, saying they changed brands because of affordability.

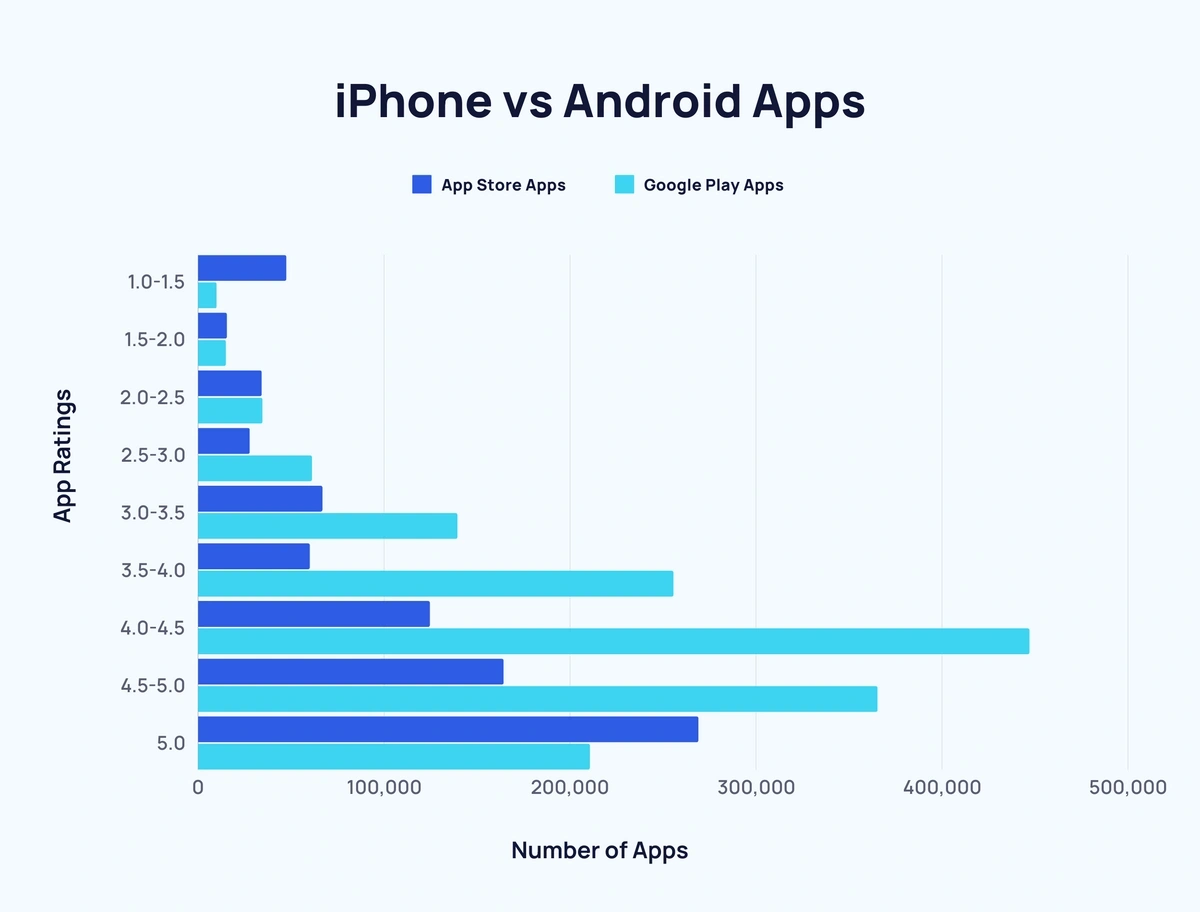

App Usage & In-App Spending

As of May 2024, there are more than 1.9 million iPhone App Store apps and over 3 million Google Play Store apps. Android has 49 distinct app categories, while iPhone apps only have 26. Both release an average of 1.2K apps daily.

When it comes to app spending, iOS users spent $85.1 billion in the App Store in 2021, while Android users spent $47.9 billion in Google Play. Around 95.2% of iPhone apps are free, while 97.7% of Android apps are free.

Factors Influencing OS Growth

Hardware and Software Launches and Price Points

Hardware releases and device prices are very significant factors that influence OS growth. Apple has released a new model every year since 2007, mostly featuring faster processing times and better usability features.

Google typically releases a new major Android version with a significant software update once a year. Android phone manufacturers usually release a new phone to feature the newest OS version. The current Android OS version is Android 14 or the “Upside Down Cake”.

5G Adoption and Data Plans

The default data settings for an iPhone is 5G, which optimises battery life and data usage. For Android phones, devices typically connect to the strongest available network, which could be 5G or 4G LTE. Android users can manually set their phones to 5G through their device settings if this service is available in their areas.

User Confidence

User confidence towards their preferred brand is also crucial to OS growth. Around 20% of iPhone users are “extremely confident” that the Apple iCloud Keychain ensures data security. Only 13% of Android users are confident that Google Password Manager keeps their data secure.

Mobile Operating System Forecast and Predictions Through 2025

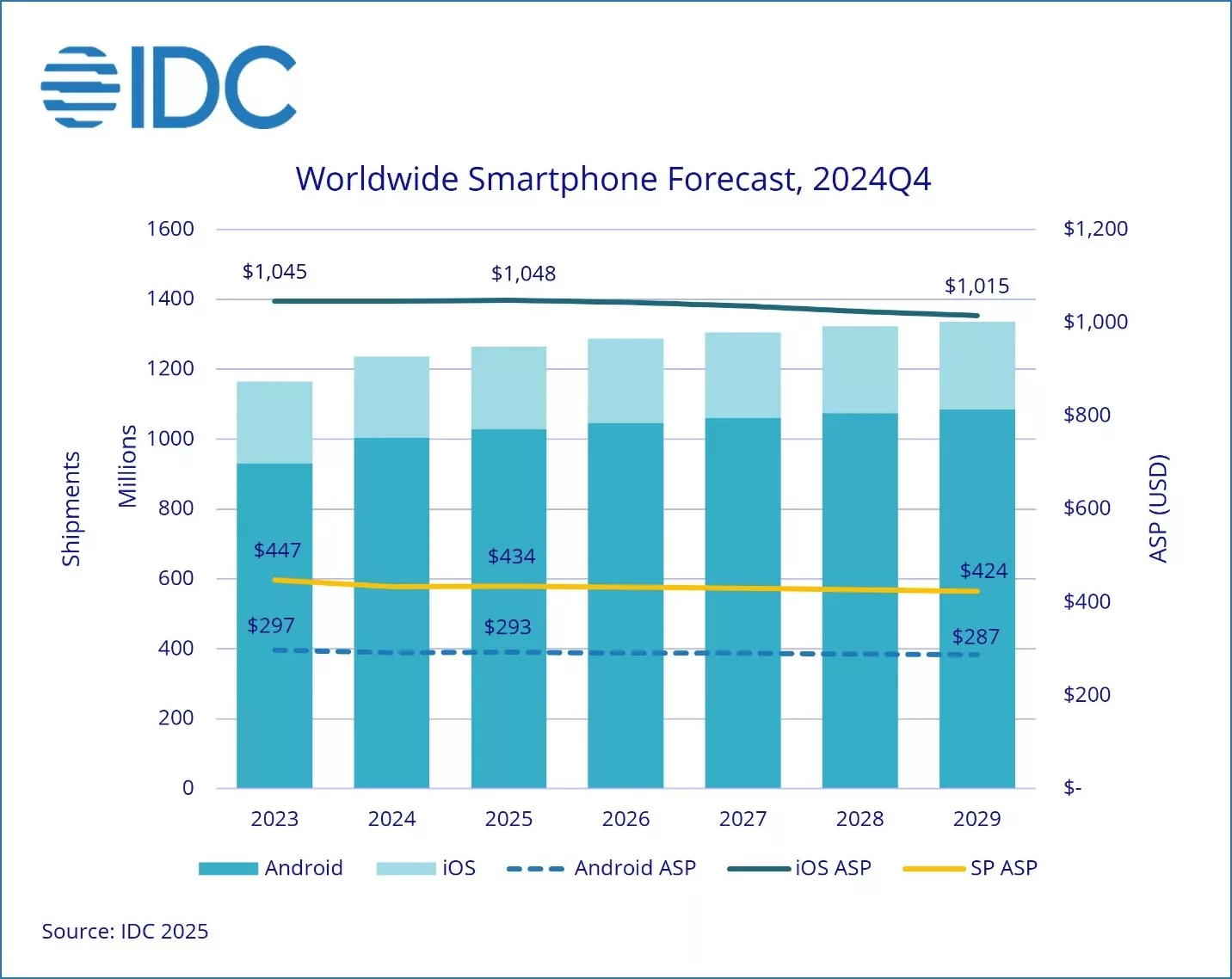

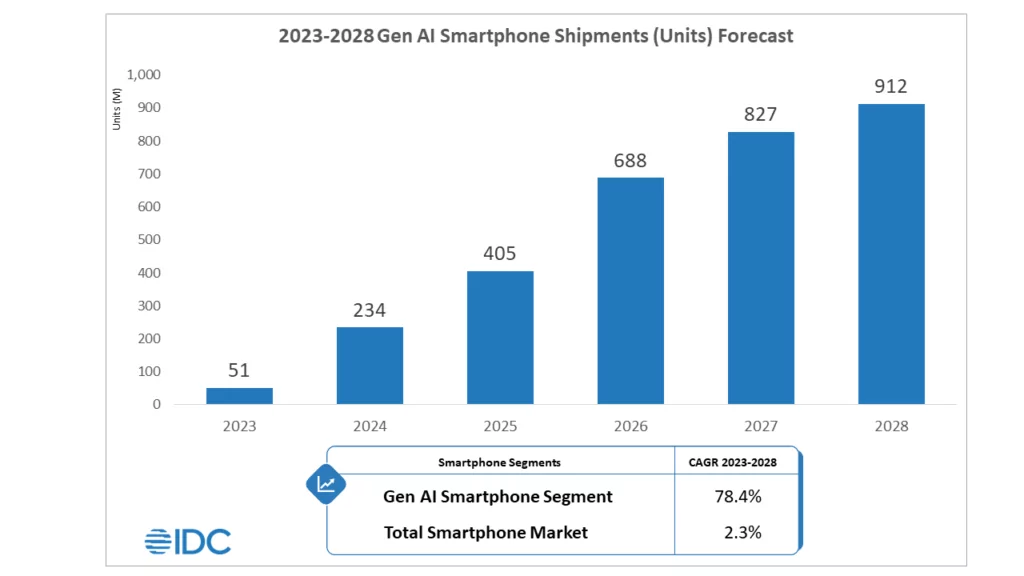

A February report on the worldwide smartphone market forecasted that the industry will grow at around 2.3% in 2025. Android smartphones will lead this growth, 40% faster than iOS devices, a 2,5% year-on-year growth despite 10% China tariffs.

Emerging Technologies

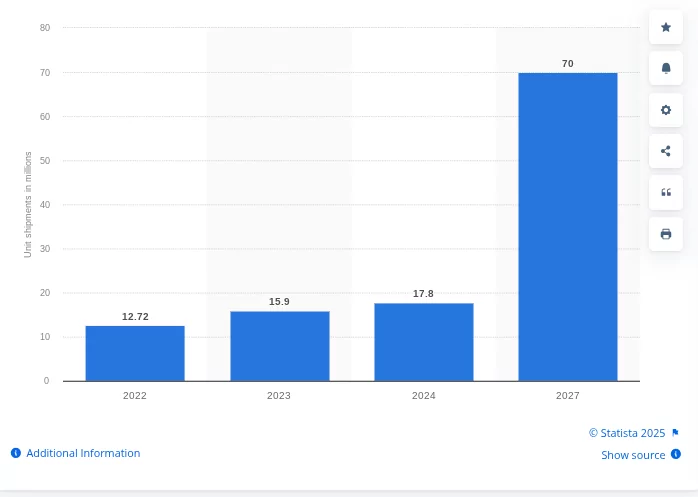

Impact of Foldable Phones

The demand for foldable phones is expected to increase from 2023 and 2027. The latest stats mentioned that around 18 million foldable units shipped by the end of 2024 are forecasted to reach 70 million in 2 years. This trend is expected to boost the popularity of Android OS further.

AR/VR Capabilities

The latest reports highlight Apple’s dominance in the VR and AR market primarily due to its integrated hardware and software. Apple’s ARKit technology and Apple Vision Pro headset offer users a more amazing experience compared to the latest options that run on Android. However, Google is developing Android XR to match Apple’s VR/AR capabilities.

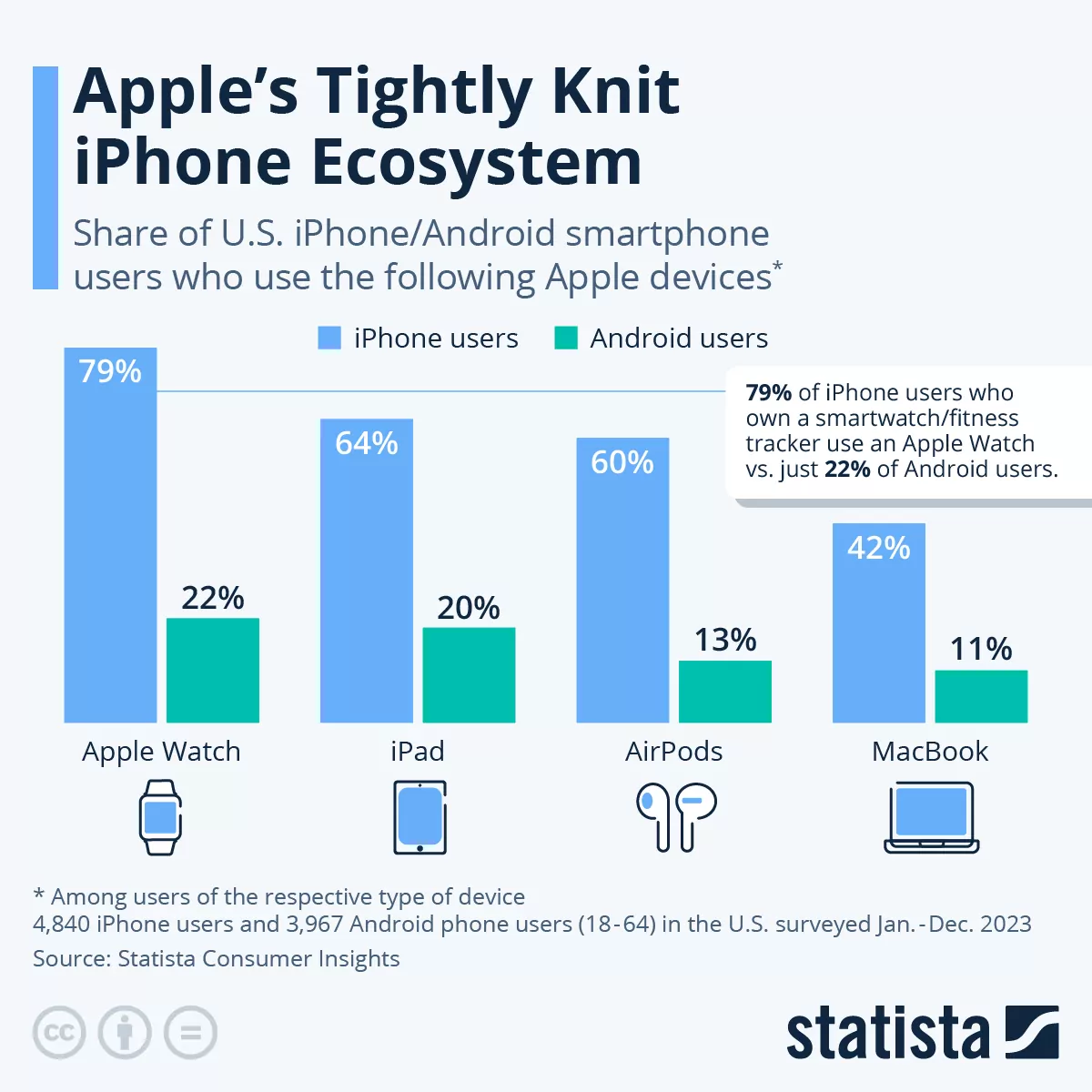

Apple’s Ecosystem

Apple’s tightly-knit ecosystem nurtures loyalty among its users and is expected to boost the brand’s popularity further. According to the latest survey, 79% of iPhone users also own an Apple-brand smartwatch or fitness tracker, 34% own an iPad, 60% own AirPods, and 42% have a MacBook.

Regulatory or Economic Influences

Changes in Data Privacy Regulations

Data privacy regulations are constantly updated to protect users from new and more vicious online attacks. These changes may affect the popularity of mobile OSs.

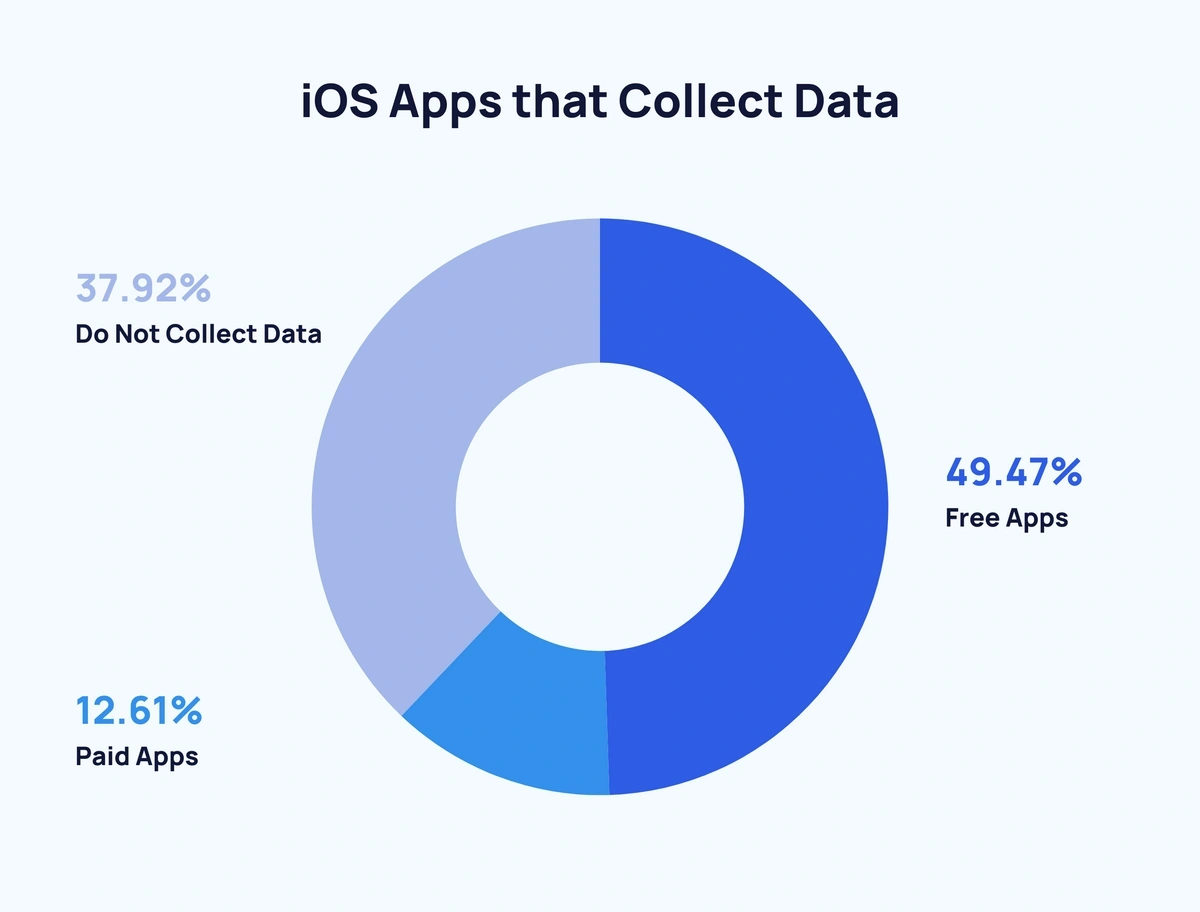

Apps can be sources of data breaches on phones. According to the latest survey, free apps are four times more likely to track user data, and 72.6% of iOS apps track private user data. Less than 25% of smartphone users are in control of their personal data.

Regulatory changes to prevent data breaches may restrict app usage among users and eventually affect mobile OS popularity.

iOS & Android Future Outlook Beyond 2025

Next-Gen OS and Ecosystem Expansions

It is predicted that beyond 2025, people will be less likely to rely on touchscreen devices. Interactions through voice, gesture, and eye-tracking will become the norm. Also, AR and VR integration will further provide immersive user experiences.

Thanks to AI, both iOS and Android phones will offer improved personalisation features. Digital assistants will have predictive capabilities, anticipating user needs and automating complex tasks. The Apple and Google ecosystem will expand further, starting with Smart Glasses, in-car entertainment and navigation, and the Internet of Things (IoT).

Brand Alliances and Acquisitions

Gen AI smartphones have system-on-a-chip (SoCs) with neural processing units (NPUs) delivering at least 30 tera operations per second (TOPS) using int-8 data for faster, more efficient on-device Generative AI processing. IDC forecasts a 364% increase in Gen AI smartphone shipments in 2024, reaching 234.2 million units.

Despite economic challenges and longer device lifecycles, demand is expected to grow rapidly, making it the fastest-expanding segment in the smartphone market. Shipments will rise 73.1% in 2025, followed by steady double-digit growth, reaching 912 million units by 2028.

Implications for Businesses & Marketers

Businesses and marketers must understand iOS and Android bases to optimise user experience, app development, and marketing campaigns.

Generally, iOS users belong to higher income levels, thus favouring premium experiences. Android has a diverse user base who prefer accessibility and personalisation.

The differences in app stores, conversion rates, and ad strategies require businesses and organisations to apply platform-specific strategies. Also, privacy changes, such as Apple’s App Tracking Transparency (ATT) and Android’s changing policies, need continuous adaptation for effective marketing.

Unlock the power of mobile usage data with Red Search to refine your digital strategy. Let our insights guide smarter decisions for better performance.

For more on Australian statistics, see our other articles:

- Australian Mobile Phone Statistics

- Australian Internet Statistics

- Australian Local SEO Statistics

- Australian ChatGPT Statistics

- Australian VPN Statistics

- Australian Youtube Statistics

- Blogging Statistics

Frequently Asked Questions

1. Which OS is more popular in Australia—iOS or Android?

About 60% of Australians prefer iOS over Android.

2. Why does iOS lead in app revenue despite Android’s higher global user base?

Despite having fewer apps (1.9 million vs. 3 million) and categories (26 vs. 49), the App Store produces higher revenue due to users’ higher spending power and willingness to pay for premium features.

3. Will 5G significantly shift Aussie OS market shares?

5G will enhance app performance and data-heavy services such as streaming and AR/VR but will unlikely influence Australia’s OS market. 5G may accelerate trends such as AR/VR adoption, cloud gaming, and IoT integration but will primarily refine existing trends rather than cause a major shift.

Written by