- Red Search

- Resources

- Gen Z Marketing Statistics

Australian Gen Z Marketing Statistics 2023

-

Daniel Law

Daniel Law

Gen Z consumers are changing the tides of today’s fast-paced digital landscape. They are paving the way to a values-oriented shopping transformation causing brands to shift their focus.

Brands utilise unconventional eCommerce platforms, embrace diversity, and are full-steam on building trust through online and in-store channels.

Considering the sheer grip of Gen Z’s in Australia’s current market landscape, it makes sense for businesses to make data-driven decisions to leverage the youth’s insatiable buying appetite.

Here, we rounded up Australia’s latest Gen Z marketing statistics to put the generation’s spending impact into perspective. Explore how the digital natives compare with other generations and how you can sustainably market to the Y2K generation.

Who exactly are Gen Z?

Born between 1997 and 2012—Gen Z is the world’s largest generation, comprising as much as 30% of the global population and about 20% of Australia’s citizens. Gen Z are seen as digital natives, living in a time of high-speed fibre internet and in an era of connectivity.

That means they are more connected than other generations and are the most ethnically diverse. But their digital supremacy doesn’t stop in demographics and mere numbers.

Because of their youth, Gen Z’s haven’t grown to their peak earning and spending power. But the latest data shows they already account for up to 36% of total retail spending in Australia alone.

It is forecasted to grow up to 48% by 2030.

That said, no business should turn a blind eye to the massive spending potential of Gen Z. But to establish a lasting bond with this age group, here’s what to look for as they step into the workforce:

Gen Z in the workforce

Love or hate it, but you can’t shake Gen Z and their values. Many Gen Z’s are known for their activism on racial injustice, climate crisis, and LGBTQI+ rights.

Gen Z’s are simply too powerful to ignore. With over 500 million people aged 18 to 24 in the Asia Pacific region, these young adults can shape Australia’s expanding economy, particularly in how businesses communicate and promote their products.

Authenticity is key in advertising

Gone are the days of fairytale ad concepts and ideas that were too good to be true. Gen Z wants businesses to promote a culturally inclusive message by focusing on diversity in advertising.

As media constantly evolves, the demand is now for connection and entertainment. About 46% of Gen Z’s prefer buying from socially proactive and responsible brands.

Moreover, a Snapchat study reveals the following values driving purchases among Gen Z’s:

- 63% favours brands with fair labour policies

- 63% prefer businesses that promote a healthy and inclusive workplace culture

- 62% will purchase products made with sustainable manufacturing processes

Trustworthiness, authenticity, and information are core attributes when developing content for Gen Z consumers. This is because these shoppers seek brands that share their values and express their personality and style.

Getting brand connection right

Gen Z are no longer kids, and as they form their values and purpose, brands must reflect them and communicate the same message to their consumers.

Research shows that 60% of Gen Z’s engage more with brand-purpose messaging, while only 52% will engage with brand messaging that lacks purpose.

Small and medium businesses have a great chance of connecting with Gen Z consumers. Think about direct ways to reach your young consumers through User-Generated Content (UGC) and establish word-of-mouth from existing consumers to new ones.

The need for representation and engagement makes word-of-mouth a powerful advertising channel. Gen Z loves to share their online and in-store shopping experiences with friends and seek advice from existing consumers and influencers.

That brings us to our next factor.

Social awareness calls for diversity

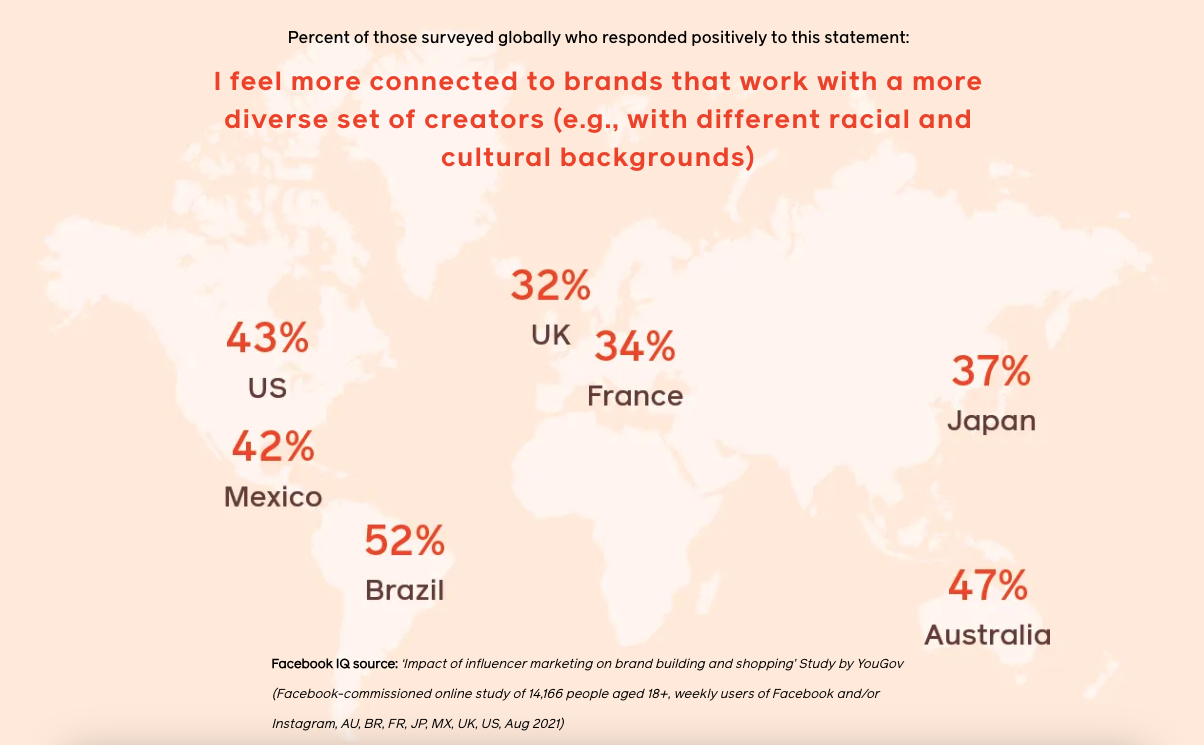

Marketing to a socially aware generation means earning their trust and understanding their diversity. In Australia, 47% of consumers feel more connected to brands with a diverse team of creators.

Source: Facebook IQ

Gen Z consumers feel that brands actively bridging the diversity gap understand them better—strengthening the trust between business and consumer.

Gen Z & eCommerce

Gen Z’s are a generation with $360 billion of disposable income! The only trick is to have them buy.

Young consumers are expected to shake up Australian retail by 2030, as they already account for about 36% of current retail spending. Along with Millenials, they will become the leading consumer group.

That number is forecasted to grow 48% as more Gen Z’s enter the workforce.

Moreover, 30% of Gen Z shoppers are showing interest in in-store shopping, but 36% would choose hybrid buying methods. Now that more options are readily available to Australian consumers, here are some hybrid retail stats you need to know:

- 75% of consumers are using at least one omnichannel collection method

- 79% will revisit a store that offers payment via messaging services (e.g., WhatsApp)

- 89% of shoppers buy in-store after finding the product on social media

- 83% say that they will revisit a store that lets them experience products through immersive augmented reality (e.g., virtual reality headsets)

Sharing data? It’s giving green flag

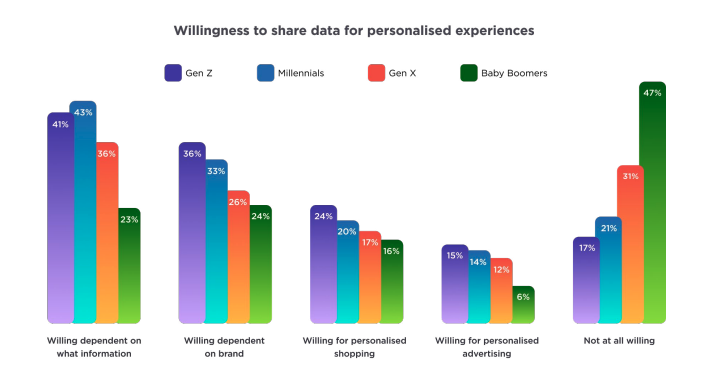

Today’s consumers are more vigilant of their data and how they share it online. However, Gen Zs are the most willing to share their data.

Here’s what the numbers say:

Source: Global Consumer Report: Current and Future Marketing Trends

- 41% of Gen Z will share their data depending on the information asked

- 36% will share depending on whether they trust the brand

- 24% are willing to share their data to enjoy a personalised shopping experience

- 15% of Gen Z’s will share their data to see personalised ads

- 17% will not share at all

Sustainability is the hottest trend

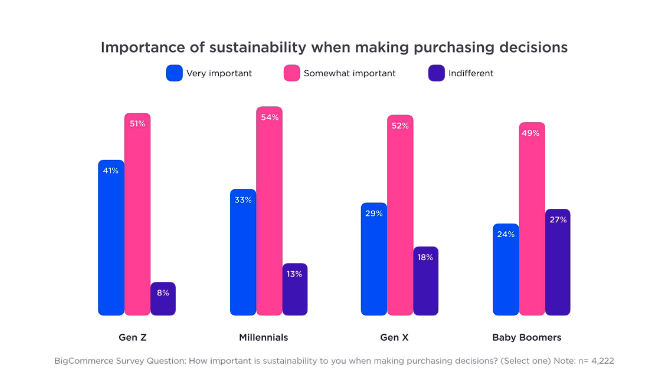

Generation Z grew up hearing about climate change and global warming, so we can’t blame them for being empathetic toward sustainability.

The study shows that the Y2K generation cares more about sustainability than the rest of the age groups.

Source: Global Consumer Report: Current and Future Marketing Trends

Only a shy 8% felt indifference about sustainability when making a purchase. On the other hand, 51% saw it as somewhat important, and 41% valued sustainability as an important factor in their purchase.

Gen Z & Millennials: Key Spending Differences

Gen Z and Millennials are becoming powerful forces in Australia’s economy. But how do their buying habits differ? We looked into Afterpay data and rounded up the following stats and facts.

Here’s how younger generations spend compared with Millennials and how that difference shapes the future of Australia’s retail.

Gen Z’s becoming the biggest growing spenders

Millennials were the first to adopt Buy Now Pay Later (BNPL) services. However, current statistics show that Gen Z is catching up.

The Afterpay study shows that Gen Z is responsible for 15% of total BNPL spending, with the biggest YoY growth of 35%.

Experience & recreation show the biggest spending

Spending on leisure made a massive comeback post-pandemic as recreation recorded the largest growth, especially for Gen Z. Afterpay recorded 90% YoY growth in sales for travel and events, gapping Millennials at 51%.

SMEs record positive YoY growth on BNPL sales

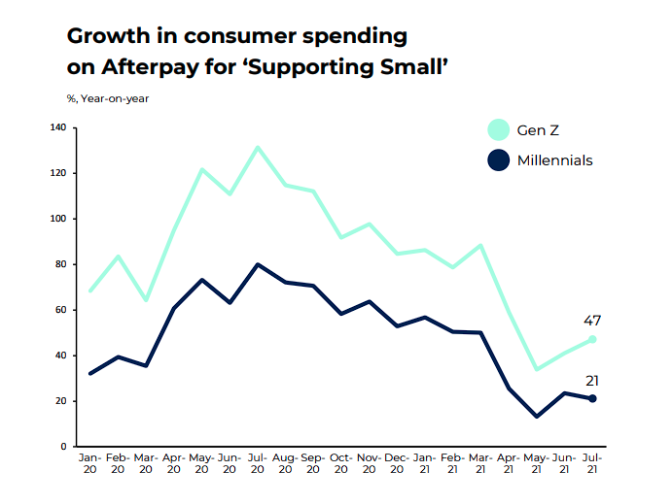

Value-driven younger Aussies are spending more on small and medium enterprises as SMEs record solid YoY growth as Gen Z’s spend 45% more under BNPL purchases.

That’s more than double the Millennials with only 20% YoY growth, indicating a positive trend for SMEs to market to younger audiences.

Furthermore, Gen Z and Millennials account for roughly two-thirds of SME earnings. Millennials spend more on supporting small businesses, with 52% overall consumer share, while Gen Z is 15%.

However, as discussed, growth is the game for Gen Z, as the survey recorded 47% YoY growth for the youth and 21% YoY for Millennials.

Millennials win on spending, but Gen Zs win on growth

It’s only a matter of time before Gen Z consumers lap Millennials on consumer share. Afterpay records show millennials currently hold 52% of the consumer spending share on the service.

However, Gen Z is full-steam ahead with the fastest consumer spending growth, currently at 35%, over Millennials, who are at 25%.

Lockdown unleashed online spending frenzy over Gen Z

Stay-at-home policies drove the general population to stay online, pushing online spending and mobile usage to an all-time high in NSW. The state’s lockdown accelerated eCommerce sales to record figures, particularly in BNPL services.

Gen Z recorded online sales growth at 70% YoY, over 43% for Millennials. This doesn’t come as a surprise. They are the digital natives, after all.

However, considering their growth in physical purchases, it won’t be long before Gen Z becomes the biggest spender.

External forces shape Gen Z spending habits

In summary, Gen Z spending will differ from that of Millennials as new external forces shape their habits as they mature into their peak buying capacity.

Most Gen Z’s have witnessed their parents overcome the Great Financial Recession in 2007-2008, and they’re leaving high school during the COVID pandemic. That said, they lived through several economic crises, causing them to avert credit and lean towards flexible debit payment options.

Gen Zs are also the first digitally native generation. They grew up with internet connectivity and smartphones, so they seek omnichannel shopping experiences.

As the first generation to fully immerse in social media and rich content, this value-centric generation demands an honest and authentic brand image. Overhyped ads filled with fluff won’t work on the youth if it doesn’t resonate with their personality and values.

Less is more, as long as you do it right.

Gen Z Shopping & Spending Statistics

As said, Gen Z is battle-hardened by successive financial crises and is shaped by social media. If there’s one thing that’s sure to raise their eyebrows, it’s credit-oriented services.

Credit? Ain’t no way

While Millennials turned their backs on credit cards, Gen Z’s aren’t even signing up!

When signing up for BNPL services, 94% of Gen Z account holders link to a debit card. That means they’re looking for flexible, low-commitment, and straightforward payment solutions that empower rather than entrap customers.

The same holds true for video streaming and other entertainment platforms. The slightest bump in flexible and budget-focused services is enough to cause Gen Z consumers to bail out.

For instance, research forecasts Netflix viewership to drop by 0.5% if it implements paid sharing on its subscribers. Young adult viewers are seen to decline the fastest, with more than a 4.1% drop in subscriptions.

Sales among Gen Z dropped post-COVID

Current research reported that spending among younger generations dropped by 5% to 7% below pre-COVID sales. But that’s not an isolated case for the youth since economy-wide spending across all ages dropped or slowed down.

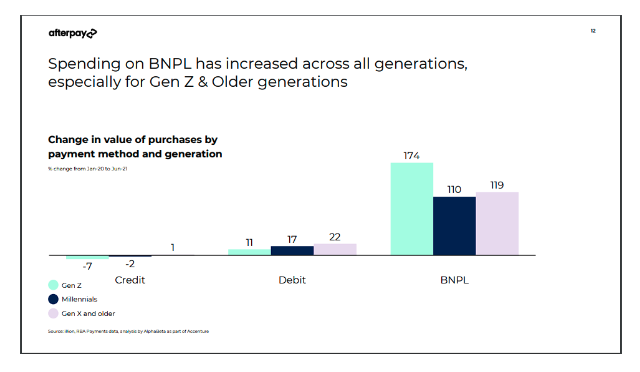

Despite the downward trend in overall sales, credit, and debit transactions, BNPL spending has risen across all generations. Here’s what the numbers say:

For Credit:

- Gen Z: -7% YoY

- Millennials: -2%

- Gen X and older: 1%

For Debit:

- Gen Z: 11% YoY increase

- Millennials: 17%

- Gen X and older: 22%

For BNPL:

- Gen Z: 174% growth YoY

- Millennials: 110%

- Gen X and older: 119%

Key Takeaways To Marketing To Gen Z

Less is more when you’re marketing to Gen Z.

Glossy ads on fantasy lifestyles won’t work with Gen Z anymore. The younger generation wants brands to showcase the beauty of everyday experiences and diversity—emphasising how relatable moments can be celebrated without over-the-top editing.

The rise of social media channels such as TikTok, Facebook, and Snapchat has made it possible for end-users to become influencers. Brands are now using TikTokers as their go-to influencers to reach and engage with Gen Z.

Gen Z users love to grow with their brands and influencers. If they follow a brand’s influencers from dawn to stardom—from zero to hero—they feel deeply connected to the brand.

This value-centric generation is shaping influencer culture and holding backlash against the privileged and elite. 84% of young consumers aged 13-39 believe big brands and the general public have equal responsibility in helping curb the Coronavirus infection at the height of the pandemic.

Marketing to Gen Z also means brands must acknowledge this generation’s social stance and political values. The Institute for Fiscal Studies found that Gen Zs were 2.5 times as likely to work in a labour sector severely hit by the lockdowns and work layoffs driven by the pandemic.

Final Thoughts

Understanding the youth’s background, demographics, and spending habits is crucial in developing sustainable, effective, and robust marketing campaigns that reach your audience and grow with them.

As Australia’s Gen Z enters the workforce, they will reshape market trends and push marketing to new frontiers.

You want to be at the forefront of this change.

Let’s talk about growing your business with data-driven insights from our growth specialists at Red Search today.

If you want to read more industry insights and love fresh data, check out our other statistics posts:

Written by