Since their debut as portable PCs, laptops have revolutionised computing and business, turning bulky machines into portable daily drivers. As we move through 2024 with 5G WiFi, AI technologies, and diverse gaming, digital marketing, computing, rendering, and longevity needs, the Australian laptop market opens up new opportunities, trends, and advancements that affect consumer behaviour.

From remote work dynamics to the impacts of the COVID-19 pandemic, the AI revolution, and global sales growth, we gathered facts and figures surrounding laptops in Australia and a list of top picks for students and businesses.

Take a deep dive into this dynamic sector’s key trends, consumer preferences, and innovations that shape the future of laptops amidst powerful mobile devices, tablets, and PCs in Australia.

Laptop Sales Growth in Australia: Year-on-Year Analysis

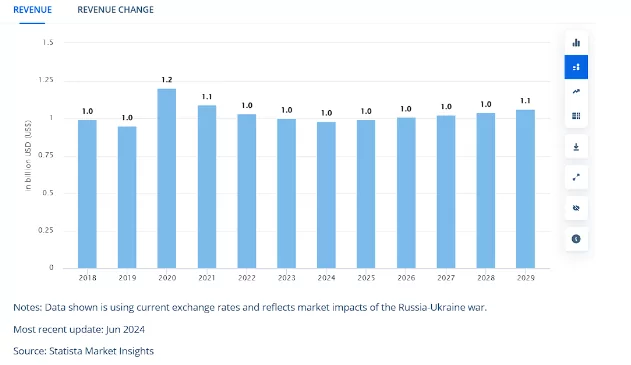

Australia’s laptop market revenue remained pretty stable from 2022 to 2024, amounting to roughly AU$1.48 billion for the three years. This is a huge gap from AU$18.12 billion of the US laptop sales in the same year, making Australia the highest-generating laptop sales market globally.

This sales revenue is projected to grow by 1.58% annually from 2024 to 2029 (CAGR).

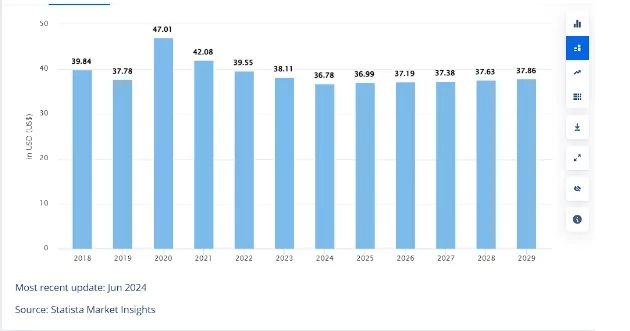

When we break it down by population, we can see that the per-capita laptop sales amount to AU$54.57 in 2024.

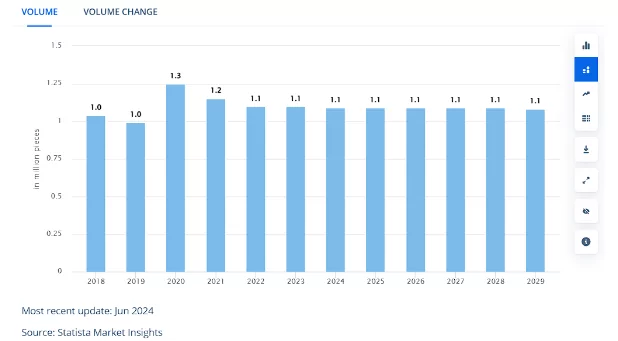

Moving forward, we can expect Australia’s laptop sales to experience a slight increase, reaching 1.1 million units sold by 2029. While this is a slight increase for a forecasted figure over 5 years, many innovations such as AI integration and ARM-ready chipsets can influence laptop buying trends and usage in the coming years.

It’s easy to infer that consistent laptop sales mean equally consistent laptop and computer ownership for Australian households. However, as the same number (1.1 million) units are sold by the year, more laptops are being introduced in the workforce and households.

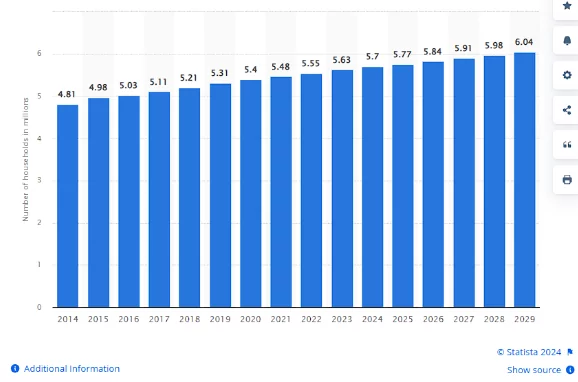

That analysis is backed by a Statista survey, where 5.7 million households own a computer in 2024 and is forecasted to grow to 6.04 million households by 2029. The continuous increase in household computer ownership supports stable laptop sales in Australia.

Australia Laptop Import and Export Market 2024

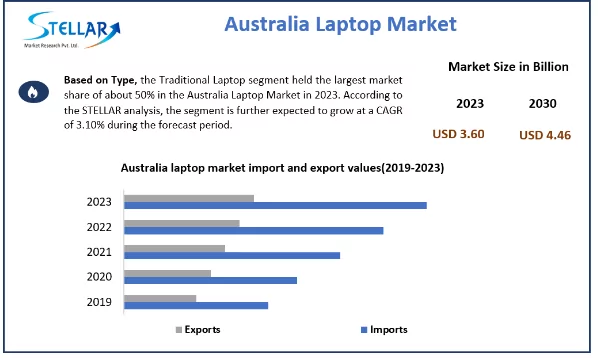

The latest import and export values for Australia’s laptop market reveal that the traditional laptop segment holds roughly 50% of the country’s laptop market. With a CAGR of 3.10%, the market size is estimated to grow to AU$6.62 billion in 2030.

Source: Stellar Market Research

Laptop Ownership in Australia (2024)

Australia’s growing demand for high-performance laptops continues to drive buying trends, especially with the advent of remote work setups, increasing computing workload, and a growing tech-savvy population.

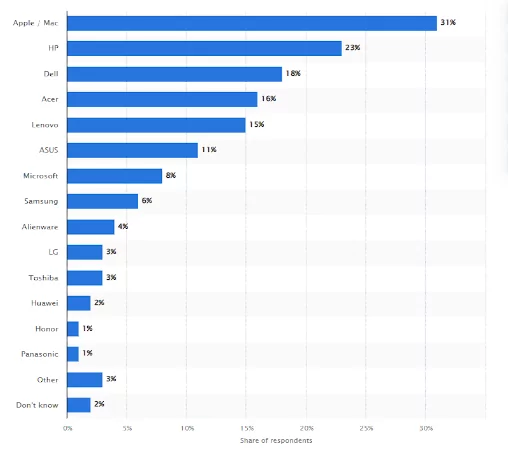

Australia’s laptop ownership demographics reveal that 31% of laptop owners use a MacBook (Apple). The next most popular laptop brand is HP, which has 23% ownership.

Considering Lenovo’s acquisition of IBM’s ThinkPad from 2005, it’s safe to say it deserves a good spot as a go-to brand for businesses. But it’s currently sitting at 5th place with only 15% ownership, right below Dell and Acer at 18% and 16% ownership, respectively.

Apple’s 31% grip on the market remains strong, but the other laptop brands from 2nd to 4th most popular units compete closely with each other.

Impact of Remote Work on Laptop Purchases in Australia

The Australian Bureau of Statistics reported that 37% of Australians work from home as of August 2023. This is a slight drop from 40% in 2021 but a 5% increase from the pre-pandemic level of 32%.

The pandemic has significantly impacted remote work setups, including laptop purchases during those periods. Looking back, laptop sales revenue in 2020 reached AU$1.78 million, resulting in a record AU$69.08 revenue per capita.

Moreover, 1.3 million laptops were sold in 2020, a 300,000 spike from 2019, slowly stabilising to 1.1 million from 2022 to 2024. This levelling-out will continue until 2029 as remote work setups become more embraced across many industries.

AI technology & Laptops

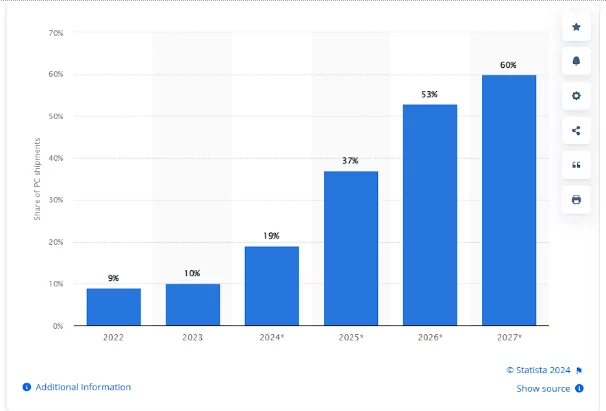

A significant breakthrough in AI technology and applications made artificial intelligence the new frontier for laptops and PCs. As of 2024, 19% of laptops sold worldwide have AI capabilities, both via cloud computing and on the device. But by 2027, 60% of computers shipped globally will be AI-capable, underscoring the rapid integration of AI into personal and business computers.

Handling AI computing offline and on-demand requires extra computing power, leading to the developing a new chip dedicated to AI.

Neural Processing Units to Boost AI

In addition to the central processing unit (CPU) and graphics processing unit (GPU), AI-capable laptops are designed with a new key component, or chip, called the neural processing unit (NPU).

The NPU is developed to take the intensive AI computing off the CPU, supercharging generative AI and machine learning to a dedicated processing unit.

Global Refurbished Laptop Market Statistics (2024)

Refurbished laptops come with several benefits for students and households as they can be purchased at a significantly lower cost for the same performance. Startups and businesses could also benefit from the refurbished laptop market, especially if they’re starting with limited budgets.

Refurbished laptops are often high-quality devices rigorously tested for quality and to ensure they’re in good working condition before getting sold. That means people could purchase high-quality laptops at a lower price.

Globally, refurbished laptops and computers sales grew at a compound annual growth rate of 8.3% from 2018 to 2022, showing a strong potential for the second-hand market.

That figure is anticipated to increase to 10.2% between 2023 and 2033 as sustainability and environmental responsibility become prominent selling points and as consumer preferences favour more sustainable options.

Laptop Usage Statistics Australia

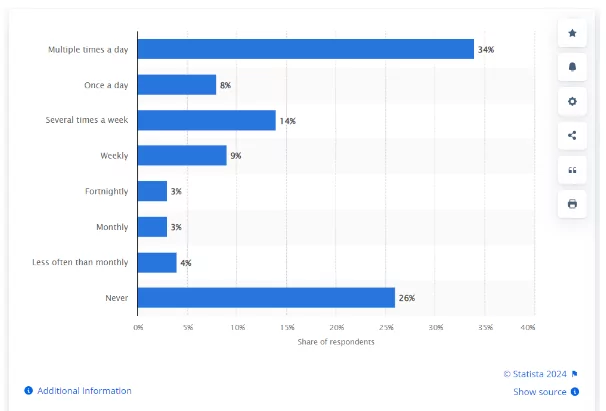

A recent laptop usage survey on respondents aged 18 years old and above revealed that around 34% of Australians use their laptops multiple times a day to access the internet. Conversely, 26% claimed to have never used a laptop to browse the internet before.

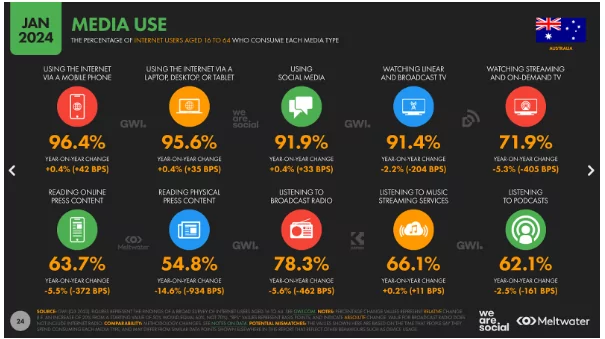

Despite a decently low frequency of laptop internet usage, the accumulated percentage of respondents who have used a laptop to access the internet is almost equal to the percentage of laptop device ownership, according to a survey conducted by Global Digital Report.

Device ownership for internet users aged 16 to 64 reported that 75.4% of Australians own a laptop or desktop computer. Moreover, 95.6% of these internet users consume media over the internet using laptops, desktops, and tablets, making them the second most used devices after mobile phones at 96.4%.

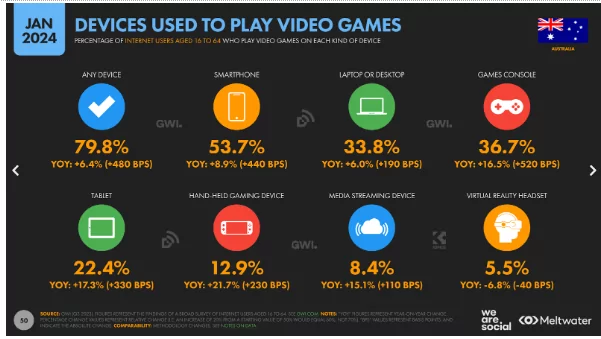

Laptops aren’t just for internet browsing; they also offer something to avid gamers and casual players. In the latest Global Digital Report for Australia, 33.8% of users aged 16 to 64 play video games on a laptop or desktop computer, placing it in third place behind gaming consoles at 36.7% and smartphones at 53.7%.

Despite lagging behind in terms of gaming preference, laptops still offer a decent gaming experience. Newer models feature more reliable cooling systems, better display and battery life, and more powerful chipsets and configurations to run power-hungry triple-A games and competitive multiplayer games that rely on high-speed internet connectivity.

Final Thoughts

Australia’s laptop market faces a challenge as more powerful tablet PCs, tablets, and smartphones redefine portable computing. Despite that, laptops remain necessary for students and businesses as newer models now feature greater capabilities of AI-ready chipsets and can handle more intensive multitasking.

While its future is not as robust as that of the smartphone industry or the 5G telecom market, the laptop market is here to stay and will remain strong. This is indicative of the changing work environment as more businesses and institutions transition to remote setups and cloud computing.

If you want to read more industry insights and love fresh data, check out our other statistics posts:

Written by

Daniel Law

Daniel Law is the SEO Director at Red Search, a specialist SEO agency based in Sydney, Australia. With over 15 years of experience in the industry, Daniel has a wealth of knowledge and expertise in search engine optimisation (SEO). He is passionate about helping businesses achieve success through effective and sustainable SEO strategies and is dedicated to staying up to date on the latest industry trends and best practices.