- Red Search

- Resources

- Christmas Online Shopping Statistics

Christmas Online Shopping Statistics Australia

-

Daniel Law

Daniel Law

As soon as November rolls around, Aussie households and shops get adorned with mistletoes and Christmas decorations to celebrate the yuletide season. Cash registers and tipping jars also get the year-end thrill as shoppers fill business districts and shopping centres.

The advent of online shopping also drove demand for digital gift-giving in Australia. Let’s take a deep dive into Australia’s Christmas online shopping statistics and visualise how the yuletide season drives the eCommerce landscape in 2022 and beyond.

Christmas Online Activities Driving Australian eCommerce Growth

Australia’s Christmas season begins in November and will stretch toward the end of January. Throughout this season, you have office Secret Santas, school concerts, year-end celebrations, family gatherings, and gift-giving with friends & loved ones.

All these yuletide activities come at a cost. From November 14 to December 24, 2022, an industry study shows that Australians may spend up to $63.9 billion in the pre-Christmas shopping period. That’s a tad 3% increase from the previous year.

A Quick Look at Last Year’s Christmas Sales

A 2021 survey on eCommerce shopping behaviour reported that more than 60% of Aussies in NSW bought their Christmas presents online. Victoria follows with 55% online shoppers, while Queensland, Western Australia, and Tasmania tied for the third spot with a 37% average online purchase rate.

1 out of 3 Aussies Turn to Online Shopping this Christmas

A 2022 survey on spending habits of 1,000 Australians reported that 32% of Australians will shop online for Christmas presents.

The same study revealed that:

- 63% of Aussies’ spending plans will remain unaffected post-pandemic

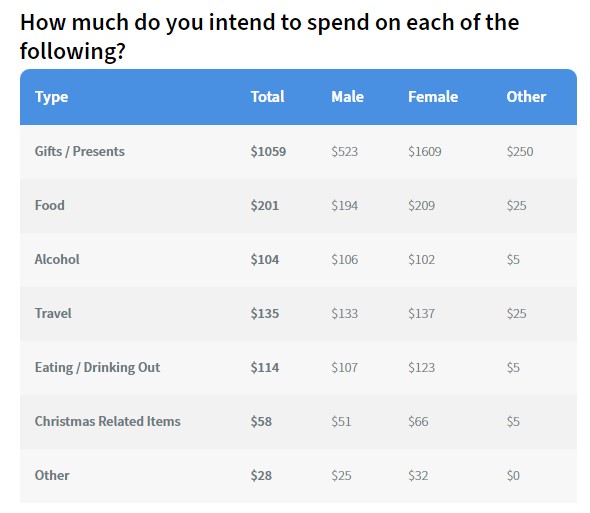

- On average, people will spend $1,059 on Christmas gifts.

- 32% will shop online in 2022, that’s roughly 8.24 million Australians

- Of those who will buy online, 12% will buy 80%-100% of their gifts online, while 43% will shop 40% of their gifts in digital stores.

- More than 70% of shoppers will pay for presents with savings.

- Women are expected to spend 3x more than men.

- Grandparents around 65 years old are expected to splurge at $2,916 on average.

The COVID-19 pandemic may have left a lasting impact on Australian consumer behaviour. But its impact could be more noticeable on Christmas online shopping.

About 33% of respondents said the pandemic had no significant impact on their shopping habits, and only 9% claimed the health crisis impacted their spending.

Looking into Australia’s spending habits, almost 50% of Aussies will spend the same amount on Christmas presents as last year. About 13% will spend more than in 2021, and 33% will pay less.

Additionally, only 8% of respondents decided to abstain from buying gifts this year.

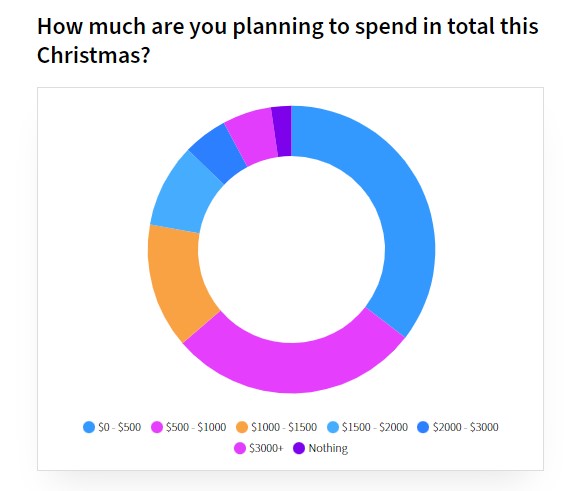

Here is a chart showcasing that most Australians will be spending anywhere from $1~$1,000 this Christmas.

Here’s a quick run-through of spending behaviour for Aussies according to age:

- 18-24 years old: 42% will spend less, with $386 average spending

- 25-34 years old: 40% will spend less, with $574 average spending

- 65+ years old: All of them claim to spend more, with $2,916 average spending

What Aussies are Buying Online for Christmas

From the same study, roughly 47% of men and 44% of women in Australia will get gift cards and shop vouchers as their Christmas present for family and friends.

About 40% will purchase toys for Christmas, while 31% are getting clothes and apparel as gifts. Novelty gifts and souvenirs are still in-demand, with 21% of Aussies buying them for Christmas. 20% will give cash as a gift this Christmas.

More Australians have taken to online shopping after getting used to it from extended lockdowns. People love the convenience of buying online, as 32% say they want to avoid crowds and 30% prefer the bargains from online vouchers.

Below is a chart breakdown from Savvy on how Australians are expected to spend their paychecks this Christmas.

Pre-Christmas Online Sales Reach Record-High

Australia’s retail industry expects a record-high sales forecast into the yuletide trading period, with consumers spending more amidst economic challenges such as inflation and cost of living.

The Australian Retailers Association (ARA) forecasts $63.9 billion in sales for Australia’s pre-Christmas buying period, recording a 3% sales increase from last year.

Businesses in the hospitality industry expect strong growth throughout the pre-Christmas period, accounting for over $9 billion in sales for 2022, a 16.3% increase from 2021.

Looking at the big picture, South Australia takes the lion’s share of pre-Christmas sales with a 6.6% record growth. The Northern Territory follows with up to a 6.5% increase, while NSW consumers are set to spend $20 billion during pre-Christmas trade, scoring a 3.1% increase from 2021.

Queensland catches up with a 4.6% increase in sales, forking over $13.3 billion in 2022, while Victorians expect the least growth (up 0.8%) with a staggering $16.5 billion in online shopping sales.

Furthermore, a Holiday Insights report by Salesforce stated that inflation and rising interest rates will kick off Australia’s holiday shopping as early as three weeks into November. Those driving factors cause the forecasted spree to fall before Cyber Week kicks off.

- About 85% of sales will occur right before the Christmas week

- One-fourth (25%) of holiday sales will occur throughout the cyber week

- Cyber Week accounts for the highest average discount rates, as much as 22%

- 70% of all online traffic will appear on mobile phones during the holidays, and 60% of that traffic will be eCommerce orders

While the eCommerce landscape expects record growth in Christmas shopping sales, the trend is not uniform across all income levels.

In 2022, the world witnessed an all-time rise in petrol, groceries, utility, and rent, and interest rates, among many others. While people in the higher income bracket will spend more for Christmas, lower-income people face a different story.

Christmas Online Shopping Statistics for Lower Income Earners

A market survey in September showed that around 40% of Aussies anticipate a frugal yuletide and will spend less on Christmas presents than the previous year.

Advanis, another research organisation, reported that 8% of 1000 Aussies won’t be able to afford the festive holiday season. The Salvation Army also noted that:

- More than 83% of households worry they may not afford presents for their children, be it from online stores or physical shops

- 61% of households with children may not afford a special feast on Christmas for their family

Christmas Online Shopping = Christmas Debt

Many Australians look for efficient ways to afford their Christmas celebrations, but some take more risks and accumulate more debts:

- 19% of Aussie shoppers use buy now pay later services to purchase Christmas gifts

- 34% that fall within the Generation Z age range are more used to online shopping channels and will shop with buy now pay later services.

- 5% of Aussies plan to open a credit card, while another 5% plan to skip loan & bill payments. Both figures increase to 8% for Millennials.

Final Thoughts

The holiday season prepares the Australian eCommerce landscape for an extended period of shopping sprees throughout the end of the year. With this comes tighter competition, and those with an effective digital marketing campaign often reap the biggest rewards.

Ramp up your SEO campaign and prepare for the yuletide rush with a data-driven SEO Sydney partner. Our best-in-class team has helped several businesses grow and take advantage of the increasing eCommerce traffic.

Contact us today, and we can do the same for your business. For your questions and enquiries, call our Sydney SEO experts on 1300 101 712 or drop a message in our contact form.

For more on Australian statistics, see our other articles:

Written by